Did you know that employers may be owed tens of thousands of dollars or more in tax credits from the Government even if they already received the PPP Loan?

The fact is that it only takes 15 minutes for you to provide some information to ERC experts and find out for free if you qualify for a refund, and for how much. Yet Billions of dollars will go uncollected by Small Businesses because they simply did not even know that they were qualified for it. The Government is not a marketing agency unless it's election time. They do not do a good job of letting people know every benefit they have. That is where the voice of "allthepeoplesay" can help.

ERC or ERTC interchangeably stands for the Employee Retention Credit or the Employee Retention Tax Credit (both are the same thing)

It was created to encourage companies to keep employees on the payroll as they navigate the unprecedented effects of COVID-19.

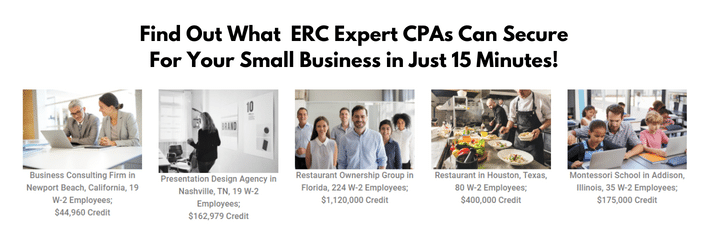

Thousands of Small Businesses have learned about a company of Expert CPAs that can help you find out for free if you qualify and for exactly how much to the penny. All it takes is 15 minutes of your time!

Imagine getting a check in the mail for tens of thousands of dollars or more that you rightfully deserve - without any hassle. It's as easy as submitting some information and waiting for your money. So why wait? Begin your claim NOW at ertc2me.com for free ERC Consulting and get the funds you deserve!

No Restrictions, No Repayments. This is not a loan!

While the Employee Retention Credit was created in the CARES act along with the PPP Loans - this is not a loan, there is no repayment.

There are no restrictions on how recipients of the credit must use the funds.

Now you may be wondering why your Bank or CPA is not talking about this service.

Employee Retention Credits are funded by the CARES Act. Your banker, CPA, or Financial Advisor was probably very helpful when it came to getting your PPP funds because they were effectively signing you to an SBA-guaranteed loan. The SBA paid the bank administrative fees based on the PPP loans they made, and so they were incentivized to educate you about the program and get all your paperwork in order.

Compared to the Employee Retention Tax Credits, the PPP program was also a rather simple calculation. 2 ½ times your average monthly payroll including health insurance and state unemployment taxes.

Many companies learned from conversations with bankers, they have no interest in involving themselves in your employment tax compliance. For them, it is a liability and beyond their scope of services.

Up to $26,000 Per w-2 Employee

Full-Time and Part-Time Employees Qualify.

The 2020 ERC Program is a refundable tax credit of 50% of up to $10,000 in wages paid per employee from 3/12/20-12/31/20 by an eligible employer.

That is a potential of up to $5,000 per employee.

In 2021 the ERC increased to 70% of up to $10,000 in wages paid per employee per quarter for Q1, Q2, and Q3.

That is a potential of up to $21,000 per employee.

Start-ups are eligible for up to $33,000.

Why Clients Choose the ERTC Consulting?

- Guaranteed To Maximize Refundable Credits For Local And Small To Medium Sized Businesses

- So Easy That Your Entire Commitment Is 15 Minutes

- No Upfront Fees To Get Qualified - 100% Contingent On Your Refund

- Audit-Proof Documentation For IRS Support

- No Other CPA Firm Offers The 15 Minute Refund™

They only specialize in maximizing Employee Retention Tax Credits for small business owners. You won’t find them preparing income taxes, compiling financial statements, or providing any attestation services of any kind.

When you engage with them, rest assured that you’ve hired the best CPA Firm to lock in this one-time opportunity for a large refund check from the IRS that will not be available forever.

Let this ERC Consulting Expert Team determine if you qualify for a sizable rebate.

By answering a few, simple, non-invasive questions this team of ERC Consulting experts can determine if you likely qualify for a no-strings-attached tax credit.

There is no cost or obligation for this full range pre-qualification by ERC Experts.

Just an easy 15 minutes process could result in your business getting the funds needed to survive or thrive!